Rumored Buzz on Transaction Advisory Services

Table of ContentsNot known Factual Statements About Transaction Advisory Services More About Transaction Advisory ServicesThe Best Guide To Transaction Advisory ServicesThe 2-Minute Rule for Transaction Advisory ServicesThe 3-Minute Rule for Transaction Advisory Services

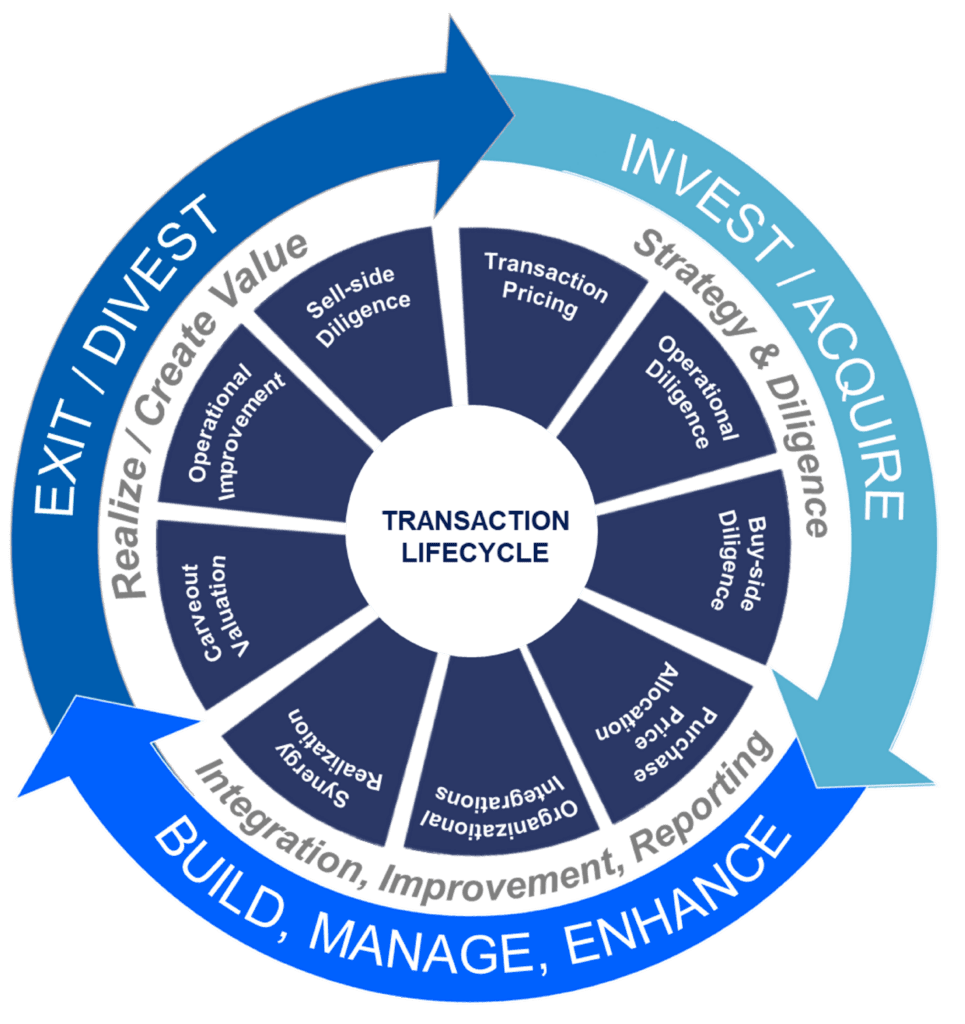

This step makes certain the service looks its finest to prospective buyers. Obtaining the company's value right is crucial for a successful sale.Deal consultants action in to aid by obtaining all the required details organized, answering concerns from customers, and setting up check outs to the organization's location. Deal advisors use their know-how to aid company owners handle challenging arrangements, fulfill purchaser assumptions, and structure bargains that match the proprietor's objectives.

Satisfying lawful guidelines is essential in any type of organization sale. Purchase advising solutions collaborate with lawful professionals to develop and review contracts, arrangements, and various other legal papers. This lowers dangers and makes certain the sale complies with the law. The duty of purchase experts prolongs beyond the sale. They aid company owner in planning for their next actions, whether it's retirement, beginning a brand-new endeavor, or handling their newly found riches.

Deal advisors bring a wide range of experience and knowledge, ensuring that every facet of the sale is handled professionally. Through critical prep work, assessment, and negotiation, TAS helps service owners accomplish the greatest possible list price. By ensuring lawful and regulatory conformity and handling due diligence alongside other bargain team participants, transaction experts reduce prospective threats and liabilities.

Not known Incorrect Statements About Transaction Advisory Services

By contrast, Huge 4 TS groups: Service (e.g., when a prospective customer is conducting due persistance, or when an offer is closing and the purchaser needs to integrate the business and re-value the vendor's Annual report). Are with fees that are not linked to the bargain closing successfully. Gain costs per involvement someplace in the, which is much less than what investment banks earn also on "tiny deals" (but the collection likelihood is also a lot greater).

The interview inquiries are really similar to investment financial interview inquiries, however they'll focus much more on bookkeeping and assessment and much less on subjects like LBO modeling. Anticipate inquiries concerning what the Modification in Working Capital methods, EBIT vs. EBITDA vs. Take-home pay, and "accounting professional just" subjects like trial equilibriums and how to walk with occasions using debits and debts as opposed to monetary statement adjustments.

The smart Trick of Transaction Advisory Services That Nobody is Talking About

that show how both metrics have actually transformed based upon products, networks, and consumers. to evaluate the precision of monitoring's previous forecasts., consisting of aging, supply by product, ordinary levels, and stipulations. to identify whether they're entirely fictional or rather credible. Experts in the TS/ FDD teams might likewise speak with monitoring regarding everything over, and they'll compose a comprehensive report with their findings at the end of the process.

The pecking order in Purchase Services varies a little bit from the ones in financial investment banking and private equity jobs, and the basic form resembles this: The entry-level function, where you do a lot of data and monetary analysis (2 years for a promo from below). The following degree up; similar job, yet you get the more intriguing bits (3 years for a promo).

Particularly, it's difficult to obtain promoted past the dig this Manager level since couple of people leave the job at that phase, and you need to start revealing evidence of your capability to create revenue to advancement. Allow's begin with the hours and way of life since those are easier to explain:. There are occasional late nights and weekend break job, but nothing like the frenzied nature of investment banking.

There are cost-of-living modifications, so expect reduced settlement if you're in a less costly area outside major monetary facilities. For all placements except Partner, the base pay makes up the bulk of the overall payment; the year-end incentive may be a max of 30% of your base wage. Frequently, the best way to raise your revenues is to switch over to Click This Link a various company and work out for a greater salary and bonus

Examine This Report on Transaction Advisory Services

You might enter into corporate growth, however financial investment financial obtains harder at this stage due to the fact that you'll be over-qualified for Expert roles. Company money is still an alternative. At this stage, you need to just stay and make a run for a Partner-level duty. If you intend to leave, perhaps relocate to a client and do their valuations and due diligence in-house.

The major issue is that because: You normally require to join one more Huge 4 group, such as audit, and work there for a few years and after that relocate right into TS, job there for a couple of years and after that move right into IB. And there's still no assurance of winning this IB duty because it depends on your region, clients, and the hiring market at the time.

Longer-term, there is also some danger of and due to the fact that assessing a company's historic financial info is not precisely rocket scientific research. Yes, people will always require to be entailed, however with advanced modern technology, reduced head counts can potentially sustain client engagements. That stated, the Purchase Providers group defeats audit in regards to pay, work, and leave opportunities.

If you liked this short article, you may be interested in reading.

The 3-Minute Rule for Transaction Advisory Services

Establish innovative economic structures that assist in determining the real market price of a company. Offer browse around here advising work in relation to service assessment to aid in negotiating and prices structures. Describe one of the most ideal form of the offer and the sort of factor to consider to employ (cash money, supply, earn out, and others).

Establish action prepare for risk and exposure that have been determined. Carry out combination preparation to establish the procedure, system, and organizational adjustments that may be required after the bargain. Make numerical estimates of assimilation costs and benefits to assess the financial rationale of combination. Set standards for integrating departments, technologies, and company procedures.

Examine the potential customer base, industry verticals, and sales cycle. The operational due persistance uses essential insights right into the functioning of the firm to be gotten concerning danger assessment and value production.